Whether you’re recovering from financial setbacks or just getting started on your credit journey, the right credit card can help you build a better financial future—step by step. The key is choosing a card that works for you, not against you.

In this guide, we’ve rounded up the best credit cards for rebuilding credit in 2025, including secured and unsecured options that report to all three credit bureaus. These picks are based on low fees, approval flexibility, helpful features, and real-world success from people just like you.

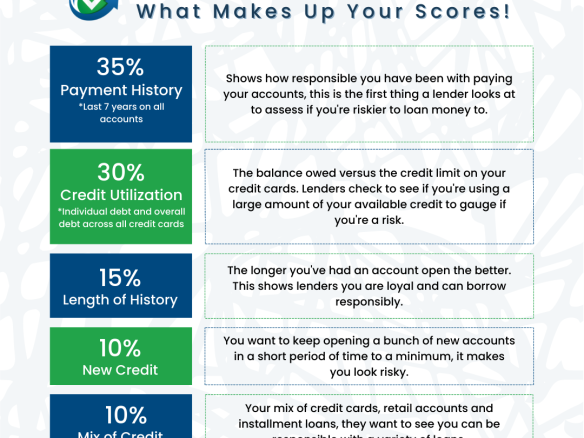

🛠️ Pro Tip: Always pay on time and keep your balance low (under 30%) to see consistent credit score improvement.

💳 Top 5 Credit Cards to Rebuild Your Credit (2025)

| Card Name | Type | Annual Fee | Credit Check | Key Features |

|---|---|---|---|---|

| Chime Credit Builder Visa® | Secured | $0 | No credit check | No interest, no fees, requires Chime account |

| Discover it® Secured Card | Secured | $0 | Yes | 2% cash back at gas stations & restaurants, automatic review for upgrade |

| Capital One Platinum Secured | Secured | $0 | Yes | Flexible deposit ($49, $99, or $200), reports to all 3 bureaus |

| Mission Lane Visa® | Unsecured | $0–$59 | Yes | Transparent terms, quick prequalification |

| Self Credit Builder Account + Secured Visa® | Secured via loan | Varies | No hard check | Combine savings with credit building |

Note: All links above are placeholder affiliate links. Replace with your affiliate tracking URLs if using.

1. Chime Credit Builder Visa® Card

- Best For: No fees, no interest, no credit check

- Why It’s Great: This secured card is linked to a Chime Spending Account and doesn’t require a credit check. There’s no annual fee, interest, or minimum deposit. You decide how much to move to your secured account—and that becomes your credit limit.

- Standout Perks:

- Reports to all 3 credit bureaus

- Safe way to build without risk of debt

2. Discover it® Secured Credit Card

- Best For: Rewards + graduation to unsecured card

- Why It’s Great: Rare among secured cards, this one offers cash back: 2% at gas stations and restaurants, and 1% on everything else. Plus, Discover will review your account starting at 7 months for a possible upgrade to an unsecured version.

- Standout Perks:

- No annual fee

- Free FICO® Score updates

- Great customer support

👉 See if You Qualify with Discover »

3. Capital One Platinum Secured

- Best For: Low deposits and gradual growth

- Why It’s Great: You could be approved for a $200 limit with just a $49 or $99 deposit, based on your credit profile. Capital One reports monthly to all 3 credit bureaus and may increase your limit over time without requiring more deposits.

- Standout Perks:

- Flexible deposit structure

- No annual fee

- Upgrade path available

👉 Apply Securely with Capital One »

4. Mission Lane Visa®

- Best For: Rebuilding with an unsecured card

- Why It’s Great: This is a good entry-level unsecured card that doesn’t require a security deposit. It offers transparent terms, quick online pre-approval, and account reviews for potential credit limit increases.

- Standout Perks:

- See if you qualify without hurting your credit

- Fast and easy approval process

- Real-time payment notifications

5. Self Credit Builder Account + Secured Card

- Best For: Rebuilding while saving

- Why It’s Great: Start by making monthly payments into a certificate of deposit (CD). Once you’ve built some savings, you unlock a secured credit card backed by your own money. This builds both credit and savings over time.

- Standout Perks:

- No hard credit pull to get started

- Dual reporting: loan + credit card

- Great for disciplined rebuilders

👉 Start Building Credit with Self »

✅ How to Choose the Right Card for You

When picking a credit card to rebuild your credit, ask yourself:

- Do I want rewards or just simple rebuilding?

- Am I comfortable with a security deposit?

- Do I need a card with no credit check?

There’s no “best” card for everyone—just the one that best fits your current needs. If you’re just starting over, a secured card with no fees is often the safest bet. If you’re already making a comeback, consider an unsecured card to avoid tying up your cash in a deposit.

📈 Final Thoughts: Rebuilding Takes Time—But It Works

Your credit score won’t skyrocket overnight, but with consistent on-time payments, low balances, and the right tools, you can absolutely rebuild your credit in 2025.

Want to see real-world proof?

👉 Read: How I Boosted My Credit Score From Under 580 to 700+ in Just 6 Months »

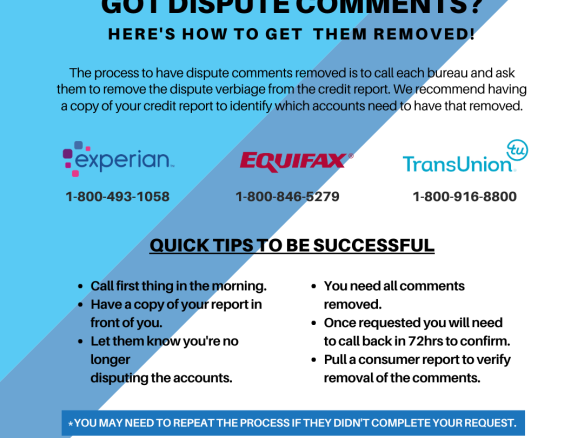

Need help designing a budget or disputing old collections? Stay tuned for our next post:

“The Credit Repair Starter Pack: Budget, Dispute Letter, and Tracker”