When it comes to improving your credit score, the terms credit repair and credit building often get used interchangeably. But while both aim to strengthen your financial standing, they serve very different purposes—and require different strategies.

If you’re not sure which one you need (or whether you need both), this guide will help you understand the difference between credit repair and credit building, how each works, and when to focus on one versus the other.

🔧 What is Credit Repair?

Credit repair is the process of correcting negative, inaccurate, or outdated information on your credit report. This typically includes things like:

- Incorrect late payments

- Accounts that don’t belong to you

- Paid collections that still appear as unpaid

- Duplicate listings

- Identity theft-related items

The goal of credit repair is to clean up your credit history so that your score can reflect your true creditworthiness.

✅ Pro Tip: You can repair your credit yourself by disputing errors directly with the credit bureaus—no expensive company required.

How Credit Repair Works

Credit repair involves a few key steps:

- Get Your Credit Reports

Request your free reports from Equifax, Experian, and TransUnion at AnnualCreditReport.com. - Review for Errors

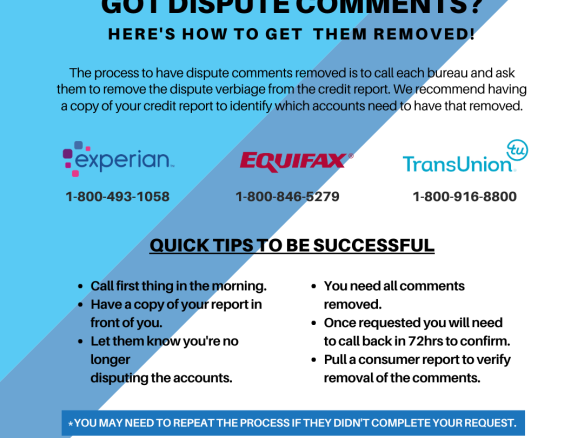

Look for any inaccuracies: wrong balances, incorrect dates, or accounts you don’t recognize. - Dispute Inaccuracies

Submit disputes online or via certified mail. The credit bureau has 30 days to investigate and respond. - Follow Up and Monitor

Continue monitoring your reports to ensure corrections are made and that no new issues pop up.

🚀 What is Credit Building?

Credit building, on the other hand, is about establishing or improving a healthy payment history and credit profile over time. Even if your credit is clean, it won’t be strong without positive activity.

This includes:

- Opening new credit accounts

- Making on-time payments

- Keeping balances low

- Maintaining long-standing accounts

Credit building is an ongoing process—one that boosts your score gradually through responsible use.

✅ Pro Tip: Even if you have bad or no credit, tools like secured credit cards and credit builder loans can help establish positive history.

How to Build Credit Effectively

Here are some common and effective ways to build credit:

- Use a Secured Credit Card: Deposit-backed cards like the Discover it® Secured report to all 3 credit bureaus.

- Try a Credit Builder Loan: Programs like Self let you save and build credit at the same time.

- Become an Authorized User: Ask a family member with good credit to add you to their card.

- Use a Rent Reporting Service: Get credit for on-time rent payments through tools like RentReporters.

⚖️ Credit Repair vs. Credit Building: Quick Comparison

| Feature | Credit Repair | Credit Building |

|---|---|---|

| Main Goal | Remove or correct negative info | Establish or grow positive history |

| Best For | Fixing mistakes, recovering from damage | New credit users, building a strong profile |

| Timeframe | Can show results in weeks/months | Takes months or years of consistency |

| DIY Options? | Yes | Yes |

| Risk Level | Low (if done right) | Low, with responsible use |

🧠 So, Which One Do You Need?

- If your credit report has errors or old collections, start with credit repair.

- If your report is clean but your score is low due to lack of history, focus on credit building.

- Many people benefit from doing both—cleaning up the past while building toward the future.

🛠️ Tools to Help You Get Started

✅ [Download: Free Dispute Letter Template (PDF)]

✅ Compare the Best Secured Credit Cards of 2025 »

✅ Read: How I Boosted My Credit Score From Under 580 to 700+ in 6 Months »

Final Thoughts

Credit repair is like removing weeds from your financial garden. Credit building is planting and growing something new. Both are essential, depending on where you’re starting from.

The good news? No matter where you are in your credit journey, you have the tools to turn things around—one smart step at a time.